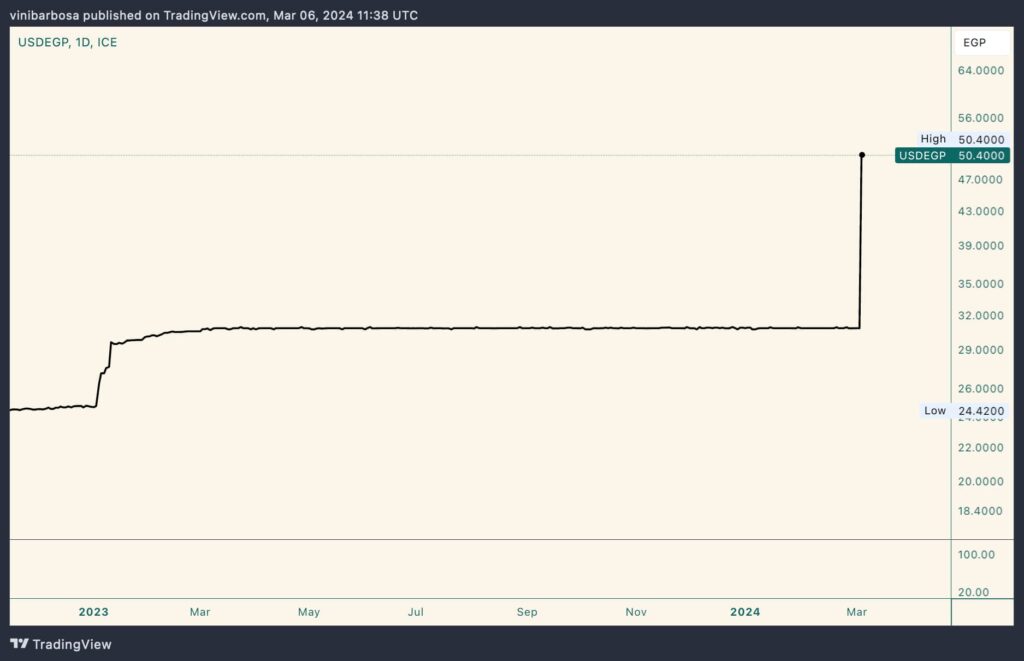

The Egyptian Pound drastically fell against the U.S. Dollar on March 6, following financial decisions by Egypt’s central bank. The USD/EGP pair jumped to 50 pounds a dollar from the historically controlled 30.85 pounds since February 2023.

In particular, the Central Bank of Egypt (CBE) decided on a 600 basis point interest rate hike in an unscheduled meeting on Wednesday. With that, the overnight lending rate increased to 28.25% and its overnight deposit rate to 27.25%.

“To ensure a smooth transition, the CBE will continue to target inflation as its nominal anchor, allowing the exchange rate to be determined by market forces,” the central bank said in a statement.

Egyptian Pound Inflation and exchange rate control

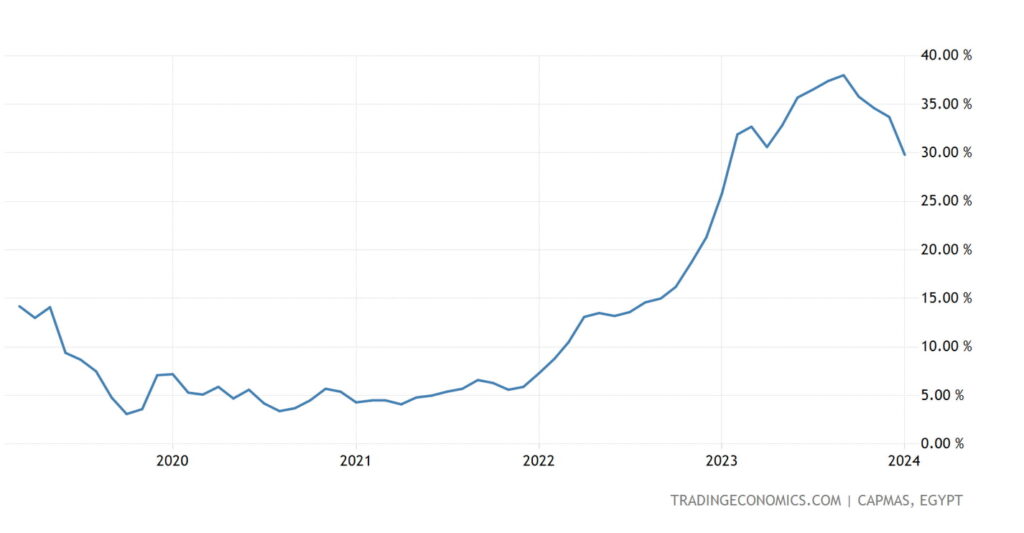

Notably, the inflation rate in Egypt – measured by Egypt’s Consumer Price Index (CPI) – has soared to historical records since 2022. In 2023, it reached an all-time high of 38% increase from the previous month, according to Trading Economics data.

However, due to a strict controlling policy, this economic catastrophe has not influenced the Egyptian Pound’s official exchange rates. Since early 2023, the CBE has arbitrarily fixed the EGP exchange rates, preventing the market from properly pricing its demand.

Previously, the Central Bank had already promised to ease the control but failed to deliver its promises until March 6, 2024. Now, the Egyptian Pound trades freely against the Dollar, lowering the premium usually observed from the black market’s exchange rates.

USD/EGP price analysis

So far, the U.S. Dollar has already seen a massive increase in value. Interestingly, it went from 30.85 pounds a dollar to a record 50.40 pounds in a few hours of the policy change—a nearly 65% increase, as traded in the forex platform Ice.

Investors speculate whether this is a first-moment Egyptian Pound panic sell or a long-term trend of the currency’s devaluation.

In the meantime, the government is optimistic about recent investments in the country, which were announced on February 23. On that note, the Emirati sovereign fund ADQ will deploy over $35 billion within two months to develop a new city on Egypt’s north coast, as reported by Reuters.

The market will start freely pricing the Egyptian Pound in the coming days. Thus, forex traders should be cautious under expected volatility, which will mainly affect the USD/EGP CBE’s previous controlled pair.

GIPHY App Key not set. Please check settings